Are you looking for the best way to calculate the average share price? If yes, then you are in the right place. We are the top-ranking website that provides a shared average calculator in India.

How to calculate the average price per share: To get the average price, you have to divide the total stock quantity by the total invested amount.

For example, if you have 897 total stock quantities and your total invested amount is 467,589, then you have to divide these two numbers like this:

Formula: Average Stock Price Per Share = Total Invested Amount / Total Stock Quantity

467,589 / 897 = 521.29

What is the Share Average Price?

The share average price is the cost at which investors invest to buy one stock. Investors calculate this amount when they buy a stock two times after the price fluctuates.

For example: an investor buys 235 units of stock when the price is 87 rupees per share. And again, he bought 387 units of stock when the price decreased to 64 rupees per stock. In that case, people calculate the average price per share.

Step-by-Step Guide to Calculating Share Average Price

Whoever invests in the stock market should calculate the average price per share. If you are an investor and have multiple stocks, then you must calculate the average price of your stocks. Because these things gave you multiple benefits, like:

Investment Analysis: If you regularly calculate the average share price, then you will know whether your portfolio is profitable or not.

Strategic Planning: Investors who use these types of calculators will always benefit. By using this calculator, they get an idea of when markets go down as compared to their average price, and they buy new stocks. This strategy is called dollar-cost averaging.

Tax Implications: If you are invested in stocks, then you have to pay the tax accordingly. When investors use this stock average calculator. They will know the actual capital losses or gains in their portfolio, which is very important while planning for taxes.

Cost Basic Calculation: When investors use this share average calculator, they know the actual cost of their shareholdings. This information will help them decide whether they should buy or sell new stocks.

What Data Do You Need to Use the Stock Market Average Calculator?

You only need the below-listed data to calculate the average share price:

- Purchase price of one share in the first transaction

- Total number of shares you bought in the first transaction

- The purchase price of one share in the second transaction

- Total number of shares you bought in the second transaction

Formula Explanation for Calculating the Average Share Price

To calculate the average price, you can use the below formula:

- Average Share Price = Total Stock Quantity / Total Invested Amount

Example Calculation for the Average Share Price Calculator

For example,

- If you bought 150 stocks for 80 rupees in your first transaction

- And you bought 180 stocks for 85 rupees in the second transaction.

- Total Stock Quantity = 330

- Total Invested Amount: 27,300 RS

- Average Share Price = 330 / 27,300

- Average Share Price = 82.73

You can also use our stock average calculator by clicking on the link or by visiting our homepage.

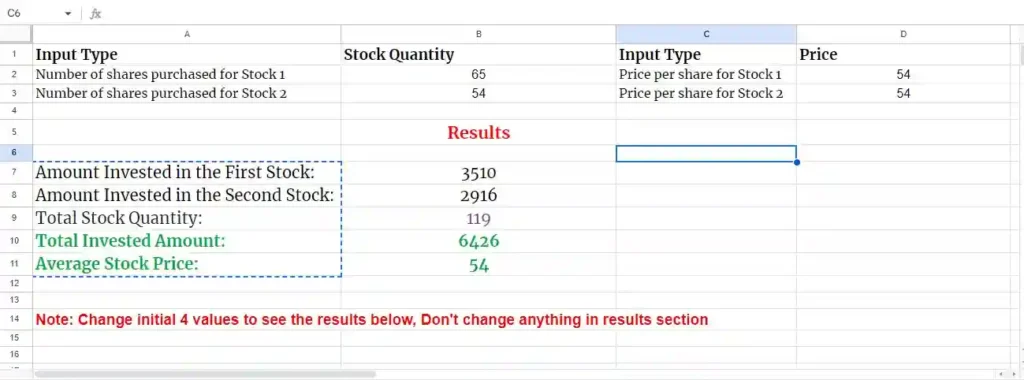

How to Calculate Average Share Price in Excel

Many people don’t know that they can even calculate the stock average price on an Excel sheet. If you want, use this share average calculator in your Excel sheet.

Then we recommend you read this article about the stock average price calculator in Excel. In this article, we write a step-by-step guide about how you can create your own calculator in Excel. And we even provide a template that you can use free of charge.

Conclusion

Many investors only invest and then forget about that. However wise investors also find opportunities to grow their investment portfolio. And by using this stock average calculator, you can keep track of your stocks.

And if you find an opportunity, then you can invest more in that portfolio. If you want to keep a record of your share market stock portfolio, then you can just follow the steps that we mention in this article. Or you can use our tool by visiting our homepage.

If you need any further assistance, then do comment below, and our team will help you as soon as possible. Thanks for reading this article till the end.