Stock Average Calculator

First Buy

Second Buy

What is the Stock Average Calculator?

Stock Average Calculator is a tool specifically built for investors, and people who buy stocks, mutual funds, or ETFs. With this tool, you can calculate the average price per share in your portfolio with just a few clicks.

How to use this Stock Average Calculator?

This stock calculator is very easy to use. You just need some information about your stocks, like the price you paid to buy one stock and the quantity of stock purchased. If you have these two pieces of information, you can easily calculate the average price per share of your portfolio.

Step-by-Step Guide for Using this Share Price Average Calculator

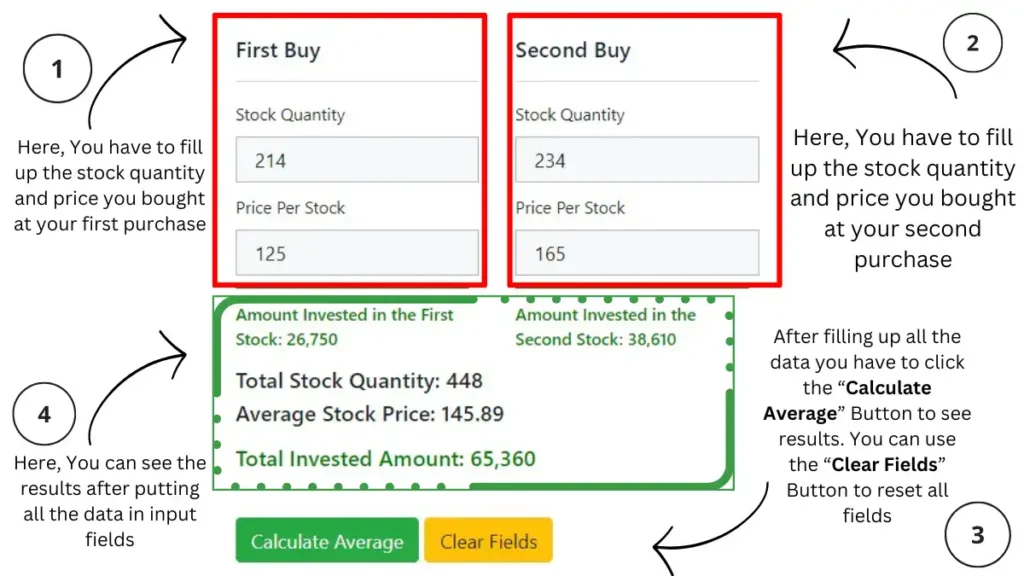

The above tool has four input fields that investors must fill out according to their stock portfolio data. We explain each input field in detail below. Here, we describe a step-by-step process to get the average price per share.

- Step: In the stock quantity section, you must put the stock quantities you purchased in your first and second purchases.

- Step: After that, you’ll see the “Price Per Stock” input fields. In this field, you must enter the price you paid to buy one stock in your first and second purchases.

- Step: After filling out all the input fields, click the “Calculate Average” Button.

- Step: Our calculator will show you the results after clicking the button.

You can follow the above-listed steps to use this calculator with ease. After following all these steps you can see the results as shown below.

What inputs should you have to fill in to get accurate data?

- First Buy: In this section, you must fill up your first stock purchase data. There are two input fields in this section, which are explained below.

- Stock Quantity: In this input field, you must enter the stock quantity you purchased in your first purchase. For example, if you bought 500 stocks in your first purchase, enter 500.

- Price Per Stock: After that, in this input field, investors have to put the price they paid for one stock. For example, if investors paid 80 rs for one stock, then investors have to put only 80 rs.

- Second Buy: Investors must fill out data about their second stock purchase in this section. This section also contains two input fields, which we describe below.

- Stock Quantity: In the second buy section, you must put the stock quantity you bought in your second purchase. For example, if you buy 390 stocks on your second purchase, you must fill in 390 in the second buy’s stock quantity.

- Price Per Stock: Here, you must fill in the price you paid to buy one stock. For example, if you spent 130 rs on one stock while making a second purchase then, you must put 130 in the input fields.

What types of Buttons are there in this Share Average Price Calculator

In our calculator, you’ll see two buttons below that allow you to get accurate data about the average share price.

- Calculate Average: After filling out all four required input fields, click this button to view the average cost of shares.

- Clear Fields: We integrate these buttons. With this button, our users can erase or reset all the data they fill in. After clearing all the input fields, they can enter new data to get the average value of their other stock portfolios.

What types of results will you get with this Average Share Cost Calculator?

With our stock average calculator, you’ll see five types of results. To see all those results, you must fill out all the input fields and click the “Calculate Average” button. We explained all the result types in the section below.

- Amount Invested in the First Stock: This result type shows the total amount you invested in purchasing your first stocks.

- Amount Invested in the Second Stock: In this result, investors can see the total amount they paid to buy their second stock purchase.

- Total Stock Quantity: Here, you’ll know the total quantity you purchased.

- Average Stock Price: These results allow investors to calculate the average price they paid to buy stocks in their first and second purchases.

- Total Invested Amount: Investors will ultimately know the total amount they invested to buy all the stocks.

Benefits of Share Average Calculator for investors?

There are many benefits of using this average calculator for stocks. Here are some significant advantages that no one tells you about.

- Portfolio Management: Investors can use this calculator to determine the average price per share they invest in each stock they buy and manage their portfolios accordingly. And can buy more shares at lower prices in the future, if they use this calculator to manage their stocks.

- Better Decision Making: This calculator allows investors to gain insights into their stock portfolio, which will help them make informed decisions, investment strategies, and market volatility before buying new stocks soon.

- Accurate and Perfect Tracking: If you have the correct data about your portfolio, then this average stock calculator will give you the accurate average share price.

- Long-Term Planning: Investors who manage their large portfolios always invest with a long-term vision. You can’t plan for the long term without the exact numbers or data. That’s why these tools will help you plan your portfolio for the long term.

- Goal Alignment: If you are investing to achieve any financial goal in the future, it can be your own home, car, land, or anything. You have to track your data monthly or quarterly. This tool will help you manage your portfolio according to your goals.

- Confidence Building: When investors know more about their investment portfolio, it gives them confidence. If they have confidence in their stock portfolio, they can make better decisions and invest in better things to achieve financial independence.

- Transparency: When anyone invests in stocks, transparency is the thing that anyone wants to boost their confidence. With this calculator, you’ll get all the details about your stocks, such as profit or loss, purchase prices, and number of shares purchased. And compute the average on a cost basis which gives you transparency.

- Continuous Growth: Investors should use this stock market average calculator to know their average share price. If you know your average share per price and total number of shares you have. It’ll improve your knowledge of your stock portfolio. You can also use this data to develop strategies for your continuous growth.

What type of information do investors need to get accurate data?

This share average calculator requires only four pieces of information about your investments to provide accurate data.

- How many stocks do you buy in the first stock purchased?

- What was the price of one stock at the time of the first stock purchase?

- How many shares or stocks do you buy in the second stock purchased?

- And at last, what was the price of one stock when you bought your second stock?

With these four data, you can calculate your average share price. If you want your portfolio to grow continuously, you should track all these data periodically.

Do investors need any financial literacy to use this average calculator for shares?

No, this calculator is easy to use. Anyone can use it to calculate their stock’s average price. If you have basic knowledge, you can easily use this tool even though we mention all the steps you must follow. You can read that guide if you feel, any issues while using this stock market tool.

Which formula does this calculator use to calculate the average share price?

Investors use this tool to get the average amount of their stocks. And if you want to know the average amount, then formulas are not that difficult, even though you can calculate that by yourself on a calculator. That’s why we also mentioned all the formulas, which our calculator uses to provide you accurate data about your stocks.

Firstly, you need the mentioned data to calculate your shares’ average amount.

- First Buy

- Stock Quantity

- Price Per Stock

- Second Buy

- Stock Quantity

- Price Per Stock

What results will you get from your data and their formula?

- Amount Invested in the First Stock = (First’s Stock Quantity) x (First’s Price Per Stock)

- Amount Invested in the Second Stock = (Second’s Stock Quantity) x (Second’s Price Per Stock)

- Total Stock Quantity = (First’s Stock Quantity) + (Second’s Stock Quantity)

- Total Invested Amount = (Amount Invested in the First Stock) + (Amount Invested in the Second Stock)

- Average Stock Price = (Total Invested Amount) / (Total Stock Quantity)

For example, if your Total Invested Amount is = 245,310, And your Total Stock Quantity is = 490 then, Average Stock Price = (Total Invested Amount) / (Total Stock Quantity) = 245,310 / 490 = 500.63

Where can you find this average calculator to know the stock average price?

If you are reading this, it means you are on our website. Now, you can bookmark our website on your browser for quick access or share our website link with your friends if they need it.

And another option is you can find us on Google by searching “stockaveragecalculator.co.in”.

You can easily find our website and use our stock average calculator by doing these three things.

Conclusion About Stock Average Calculator

This website provides a stock average calculator to our readers. With the help of our calculator, investors can calculate the average price of their stock from their portfolio. We built this website to help investors, traders, or individuals track their portfolios.

This calculator is easy to use. Anyone can use it with some details. And they’ll get a lot of data, which will help them grow. We also provide in-depth information about how this calculator works, what info they need to get the average price, and what formula we use to calculate the average amount of stocks.

If you have difficulties using this calculator, contact us through our contact page. If you need any new features in this calculator, please let us know so we can improve its functionality.

FAQs: Average Calculator for Stocks

Yes, it’s free you don’t have to pay a subscription fee to use this calculator.

If you manage an extensive portfolio of stocks, you should calculate the average price. It’ll give you more transparency, confidence, and accurate data, which will help you make better decisions for continuous growth.

Use this stock price average calculator when adding new stocks to your portfolio. It allows you to manage your portfolio according to your financial goals.

Yes, we always do the periodic test with our calculator. So, we can guarantee you’ll get accurate data based on the details you fill in in the input fields.

Yes, absolutely. If financial advisors manage your stocks, you can share this data with them only if you have no problems with it.

We don’t store any data in our database. So, yes, this data is secure.

Yes, if you are facing any issues while using this calculator. You can contact us at [email protected].

Yes, you can also use this calculator for other types of investments.

No, currently, we are not providing this option to our users.

Disclaimer

We (StockAverageCalculator.co.in) do not provide financial advice to anyone, nor do we provide legal or accounting services. Our website never recommends anyone about any stocks to buy or sell. We are just a simple website that offers a tool to calculate the average price. And we are not associated with any company or brand. Here, you can read our full disclaimer.